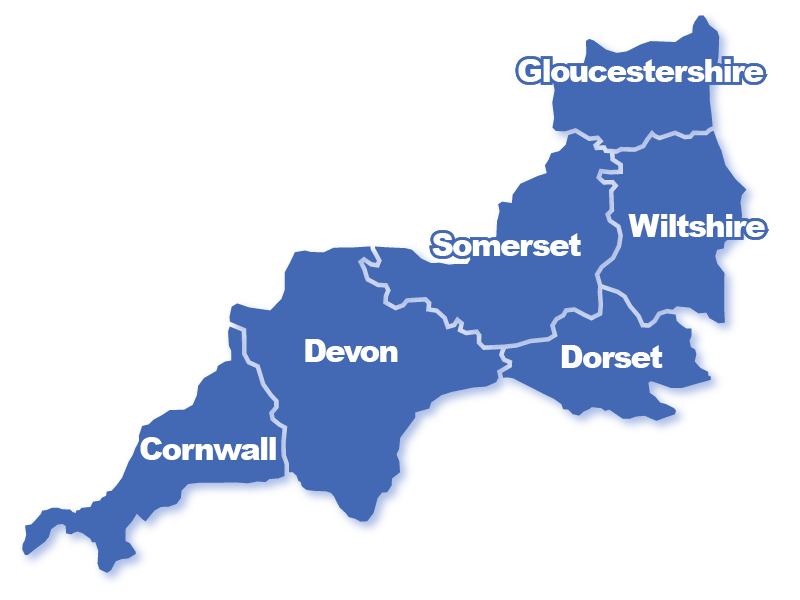

WestCountry Capital is a joint venture between Equity Matters and Bestport Private Equity. WestCountry Capital is investing in established, high quality growing businesses in the six counties of the West Country. We also provide access to the investment opportunity via offering an allocation of the equity to local investors on a deal by deal basis.

WestCountry Capital typically invests between £3m-£10m in fast-growing, cash generative businesses with a minimum EBITDA of £1m at the point of investment. A potential investee company will have a highly focussed and ambitious management team and strong growth prospects either through organic growth and/or carefully targeted acquisitions.

We consider West Country-based companies in most sectors but are particularly active in food & leisure, business services, education, healthcare services and technology.

WestCountry Capital primarily provides capital to assist management teams in acquiring the company they already run but we also consider backing existing owners in executing an accelerated growth plan.

All investments are focussed on generating substantial capital gains for all shareholders through profitable exits within a three to five-year timeframe.

We offer local investors access to high quality investment opportunities in businesses in the less competitive, lower mid-market private equity segment in the UK.

Our investors, which include institutions, family offices and private individuals, are able to invest in each opportunity directly on a self-select basis.

Ashley is a founding partner of WestCountry Capital having lived and worked in the West Country for 25 years.

After becoming a barrister, Ashley travelled to Australia where he began his career working as a fund manager for Schroder’s, Chemical Bank and then setting up his own fund management company along with a partner from Morgan Grenfell, Risk Averse Money Managers which he built to over $1 Billion AUD under management. This company was sold to Macquarie Bank before Ashley returned to the UK to continue his career in corporate advisory work.

Ashley has advised numerous businesses on their growth, succession and exit strategy. He has co invested with MBO teams and private equity houses to ensure an optimum outcome for his clients. Clients over the last 15 years have included Pasta King, Ministry of Cake, Bart Spices, Atlas Packaging, Noble Foods, Calendar Club, Nu Heat and some 20 other companies.

Ashley holds a law degree from Jesus College Cambridge, was called to the Bar and has an MBA from Macquarie University NSW.

Ole is a founding partner of Bestport and has extensive experience of private equity investing in the UK.

He began his finance career with Price Waterhouse and joined Close Brothers Group PLC in 1996 to help launch their smaller venture capital investment arm. Between 1996 and 2005 he was instrumental in building Close Venture Management (“CVM”) from an early stage to a highly successful venture investment business with some £130 million under management.

During his time with CVM, Ole led investments in over 20 ventures such as Careforce Group PLC, Dolphin Nurseries Ltd, Cassium Technologies Ltd, Intercare Group, and Grosvenor Health Ltd. In 2005 he, together with James Stoddart, founded Bestport which has successfully raised and invested institutional and HNW private equity funds in over 15 companies.

Ole holds a Bsc (Econ) from the London School of Economics and an MBA from Columbia Business School.

James is a founding partner of Bestport and has extensive experience of private equity investing in the UK.

He began his career working in corporate finance for Oppenheimer in New York followed by a three-year role in corporate strategy for Hutchison Whampoa in Hong Kong. He then spent six years engaged in corporate turnaround work for Postern before establishing Bamboo Investments PLC, raising £16 million to make early stage, high growth venture investments predominantly in the technology sector.

James has backed a number of successful businesses including Creditcall, Active Hotels Ltd, Dot Net Solutions, Bango.net and Dr Foster. In 2005 he, together with Ole Bettum, founded Bestport which has successfully raised and invested institutional and HNW private equity funds in over 15 companies.

James holds a Bachelor of Science degree in Business from Boston University.

Andy is an Investment Director at Bestport.

He joined the team in August 2019 from Grant Thornton having spent several years in the M&A team, focussing on the execution of transactions in the lower mid-market. During this time, Andy completed multiple buy-side and sell-side deals in the £5m to £50m Enterprise Value range, both in the UK and cross-border. He has extensive experience of executing deals on behalf of both Entrepreneurial Owner-Managed clients and Private Equity.

Prior to Grant Thornton he spent three years in EY’s audit practice where he qualified as an ACA. Andy also has a BA (Hons) degree in Economics from Durham University.

If you would like to speak with us about your business and capital requirements, or investing with WestCountry Capital please contact:

Ashley Levinson

Ole Bettum